As the Life insurance industry continues to look for innovative ways to respond to the changing needs, expectations and buying preferences of 21st century consumers, SCOR has responded by expanding our R&D capabilities to better assist and partner with our client companies. SCOR’s R&D team of actuaries, underwriters, data scientists and statisticians is focused on providing value-added intelligence and advice around the mortality risk implications of using risk scores and new data sources in accelerated and enhanced underwriting programs.

Accelerated Underwriting: A Growing Priority

With the changing demographics of potential life insurance buyers, particularly the emerging Millennials and the declining availability of the underwriter workforce, insurers are increasingly recognizing the need for a faster, less intrusive, digitally-based insurance buying experience. But where simplified issue programs have succeeded in achieving speed and less intrusiveness, they have not been able to do so at a price that is competitive with what is normally only available through a traditional full medical underwriting process. As a result, accelerated underwriting programs, which can offer speed, less intrusiveness and competitive pricing, have become a key initiative for many insurers.

Many new data sources have become readily available and are cost effective, such as criminal records checks, clinical lab histories and risk scores based on credit attributes or prescription drug (Rx) history. SCOR’s R&D team studies have shown these data sources to have statistically significant mortality risk attributes that can supplement or, in some cases, replace traditional fluid-based underwriting inputs, often with minimal mortality risk implications. It is often challenging for companies to assess the relative mortality impacts of these new data sources, alone or in combination with others, and to determine which data sources are most relevant for the particular accelerated underwriting program objectives which the company wants to pursue. That challenge is what SCOR’s R&D team is committed to address.

SCOR’s R&D: A Partnership Approach

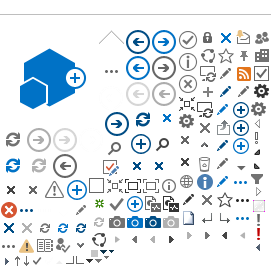

SCOR’s R&D team takes a partnership approach to help client companies evaluate mortality risk. The evaluation process starts with clear understanding of the client’s business profile (e.g., target market, distribution channel, product set, past mortality experience, etc.). Differences in target markets, distribution channels and product sets can lead to significantly different mortality risk profiles and implications from one client to the next, as seen in the distribution of credit based risk mortality scores of applicants from three different client companies shown in Figure 1.

Equally important is understanding the needs and objectives of the program or underwriting changes being considered and what the client hopes to achieve. Objectives and reasons for exploring accelerated underwriting and new data sources can vary significantly by client. Examples include:

- better segmentation of good risks in an applicant pool (e.g., Std/Pref/Super Pref

- quick exclusion of non-standard risks (e.g., rated or declines) from a speed program

- reducing mortality risk for improved performance or pricing

- reducing underwriting timelines for a greater proportion of applicants

- reducing underwriting expenses

- optimizing existing underwriting resources

- improving overall life insurance buying experience

- all or any combination of the above

Knowing which objectives apply as well as the priority order of the objectives can lead to different solutions. So whether performing client-specific mortality studies or evaluating mortality risk implications of accelerated underwriting programs, understanding the client’s business, their key objectives and working in partnership with them is essential to delivering a customer-centric solution or recommendation.

Evaluating Accelerated Underwriting Programs: A Disciplined Process

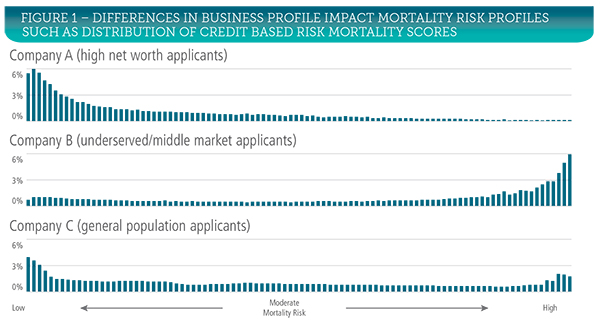

For evaluating accelerated underwriting programs or enhancements to existing programs, SCOR’s R&D team follows a disciplined analytical approach. As described previously, the process begins with an understanding of the client’s business and objectives and then moves into the workflow process shown in Figure 2.

Figure 2 - R&D Workflow Process

To perform the analysis, the team acquires and evaluates the extent of available client data. Although SCOR has extensive expertise and data sets that can overcome certain holes in client data, the larger and more detailed the client, the more meaningful will be the analytical results.

A data set that includes all applicants (including not-taken and lapsed policies along with prior declines) can provide much more analytical value than data that only includes policies issued or inforce. A data set that includes Rx or credit risk scores attributable to individual applicants has more value than data that only includes scores anonymously ascribed. The more detailed and credible the client data, the more relevant and credible will be the predictive analytical results.

Once the client data has been acquired, scrubbed and initially analyzed (the Synthesis phase), an iterative analysis and review process begins (the Usage phase) that can vary by client. In some cases, the process moves directly into evaluating data sources and testing different parameters; in other cases, a client will provide their own initial analysis and ask for validation. In still other cases, a client-specific mortality experience study may be needed before program analysis can begin.

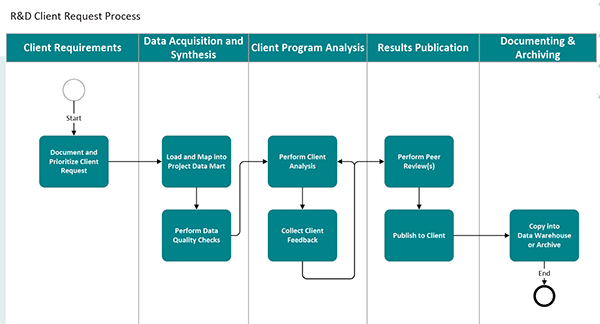

The analyses in this phase can include a number of elements – assessing class shift expectations (i.e., expected changes in the proportions of business across risk classes – see Figure 3), inclass mortality risk adjustments, overall adjustments, etc. If the final analysis results in any expected mortality or class shifts, the Pricing team will likely be engaged to discuss potential mortality assumption and pricing implications.

The most important step in the process is the communication of results to the client (the Publication phase). Translating results of a highly complex analysis (one that incorporates a multi-variate set of both independent and interdependent factors) into an easy-tounderstand presentation can be quite challenging.

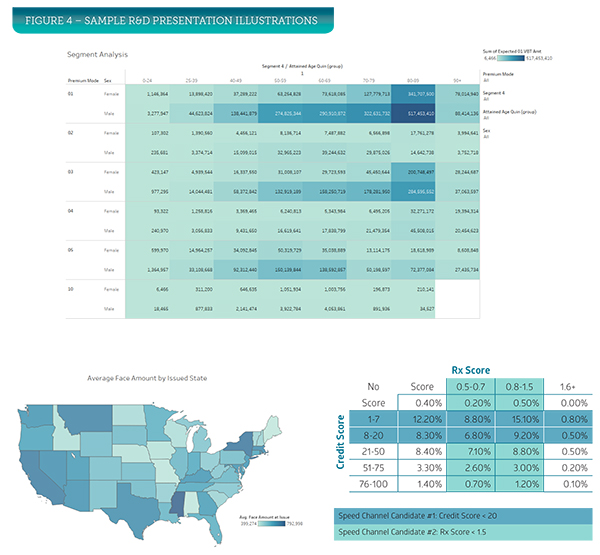

Whether using a report format or a slide presentation, being able to visually represent findings and conclusions is key to effectively communicating the results. Figure 4 (see next page) contains some sample graphs and charts commonly used by the R&D team in presentation materials. The final step in the process involves documenting and archiving the analysis and results in order to leverage the learnings for future client requests.

SCOR: Leadership in Innovative Solutions

The current versions of accelerated underwriting proposals are new, have no credible historical experience data and can be challenging to risk assess. However, the innovative analytical work performed by SCOR’s strategic R&D team, combined with SCOR’s willingness to price and risk share in these programs, is both client centric and solution oriented. It is a value-added element of the partnerships that SCOR has with client companies and is a contributing factor to the reputation that SCOR has enjoyed as an industry leader in underwriting process innovation for more than a decade.

Clients interested in partnering with SCOR’s R&D team to explore their own potential accelerated underwriting programs should contact their SCOR account executive for further information.