For life insurers, pandemic risk has been part of the risk management conversation for nearly two decades. It’s a tough risk to nail down but the industry is making headway in understanding the changing nature of the pandemic threat and developing methods to quantify and make provisions for the risk. SCOR is committed to furthering industry knowledge/management of pandemic risk, and is hosting a two-day webcast in July on this important topic.

Stakeholders Demand More Detailed Analysis

Some drivers of the recent uptick in activity around pandemic risk include Solvency II and the NAIC’s Own Risk and Solvency Assessment (ORSA) requirement. Additionally, economic capital initiatives, principles-based concepts and modeling of mortality catastrophe bonds have each played a role.

For example, under Solvency II and ORSA requirements, entities must quantify their risk appetite and risk tolerances. They must also provide monitoring mechanisms and prepare risk management and mitigation plans in case of extreme loss scenarios.

Solvency II also requires entities to maintain capital to meet the Solvency Capital Requirement (SCR). The SCR provides a standard formula for assessing its various component risks. Since the standard formula is meant to cover a variety of entities, it defines a single scenario at a conservative 1-in-200 year level. Many companies may choose instead to use internal models to define, measure and manage their particular pandemic risk, using tools and concepts appropriate for their business.

Internal models can also create a more robust picture of a company’s risks. Instead of a single scenario, one can design an internal model that provides a full probability distribution of its pandemic risk, and not just a particular scenario at a given level.

In addition, a company could use various methods of measuring tail risk such as Value at Risk (VaR) and Conditional Tail Expectation (CTE, also known as TailVar) for different aspects of the analysis. All internal models should include assumptions about correlations across various geographical regions and risk types. Specific attention should be given to correlation of risks in the tail.

Several insurers and reinsurers have purchased mortality catastrophe bonds to help mitigate their tail risks. Bond issuers require extensive analyses and stochastic modeling of all the various mortality risks involved, including pandemic risk. Industry analysts and credit rating agencies similarly want to see this type of detailed information. This increase in regulatory and external interest in the pandemic risk issue has prompted expanded research and development of tools that allow more robust analysis of pandemic risk.

More Outbreaks, Faster Containment

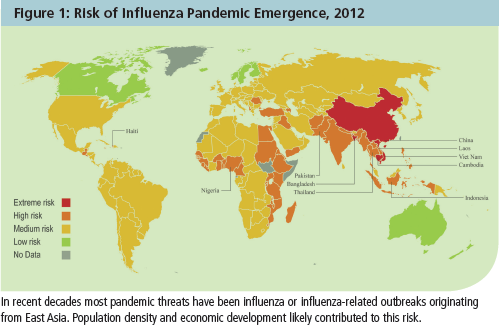

While most attention focuses on influenza as the cause of pandemics, other infectious diseases can also cause pandemics. Non-influenza pandemics have occurred less frequently through history but can result in more severe mortality.

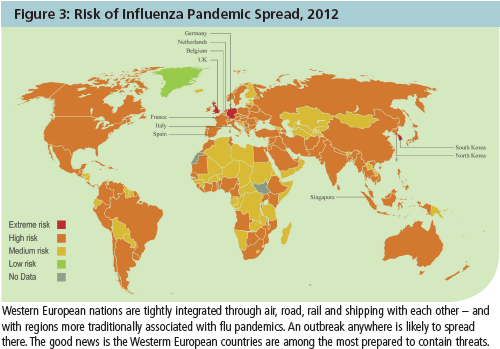

A pandemic of any kind would affect the world differently today than in the past. Over the past hundred years, global travel has become much faster and affordable, allowing infectious disease to spread more rapidly. The emergence of superbugs and drug-resistant bacteria would serve to increase morbidity and mortality due to a pandemic.

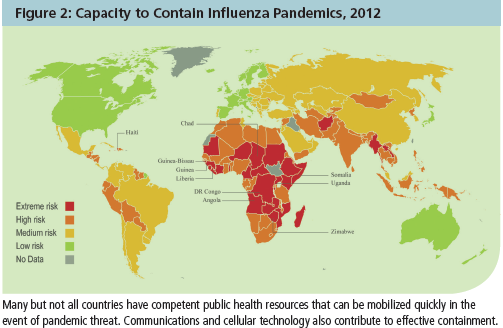

Some changes are good: modern communications such as radio, television, internet and mobile telephone can save lives. These media provide fast means of sharing information, which can aid the speedy implementation of public health measures and help scientists develop and produce vaccines.

Other advances over the past century have improved society’s resilience as well. The rise of the field of virology has led to better diagnostics for detecting the sources of diseases. Improved sanitation and hygiene have lowered the probability of transmission. The development of vaccines and antibiotics has enabled monumental strides in reduction of mortality due to infectious diseases.

Deeper, More Detailed Insight

An epidemic could affect an insured portfolio quite differently than the general population. Likewise, various countries are likely to experience an outbreak differently due to local geographical conditions, ease of travel and socioeconomic conditions.

Modern research on pandemics can provide insight on the impact of outbreak on subsets of the population. To aid in risk management, insurers are particularly interested in research on the impact of pandemics on:

-

Age – insured portfolios tend to have age profiles distinct from the general population

-

Socioeconomic status – depending on the target market, insured portfolios tend to have different socioeconomic profiles than the general population

-

Underlying health conditions – preferred risks are likely to exclude many impairments (i.e., cardiovascular and respiratory disease) that are additional risks in pandemic scenarios.

Be Prepared

A pandemic risk model should reflect all characteristics of an insurance portfolio. It should provide managers with a means to understand, measure and manage pandemic risk and thereby help provide an optimal risk-return profile. Detailed level of analysis, down to the product level, could someday become the state of the art in the life insurance industry.

Regulators and capital markets entities are already starting to ask for this type of information. Even if they were not asking for it, life insurers have many business reasons to develop this level of analysis on their own – and their competitors may already be doing so.